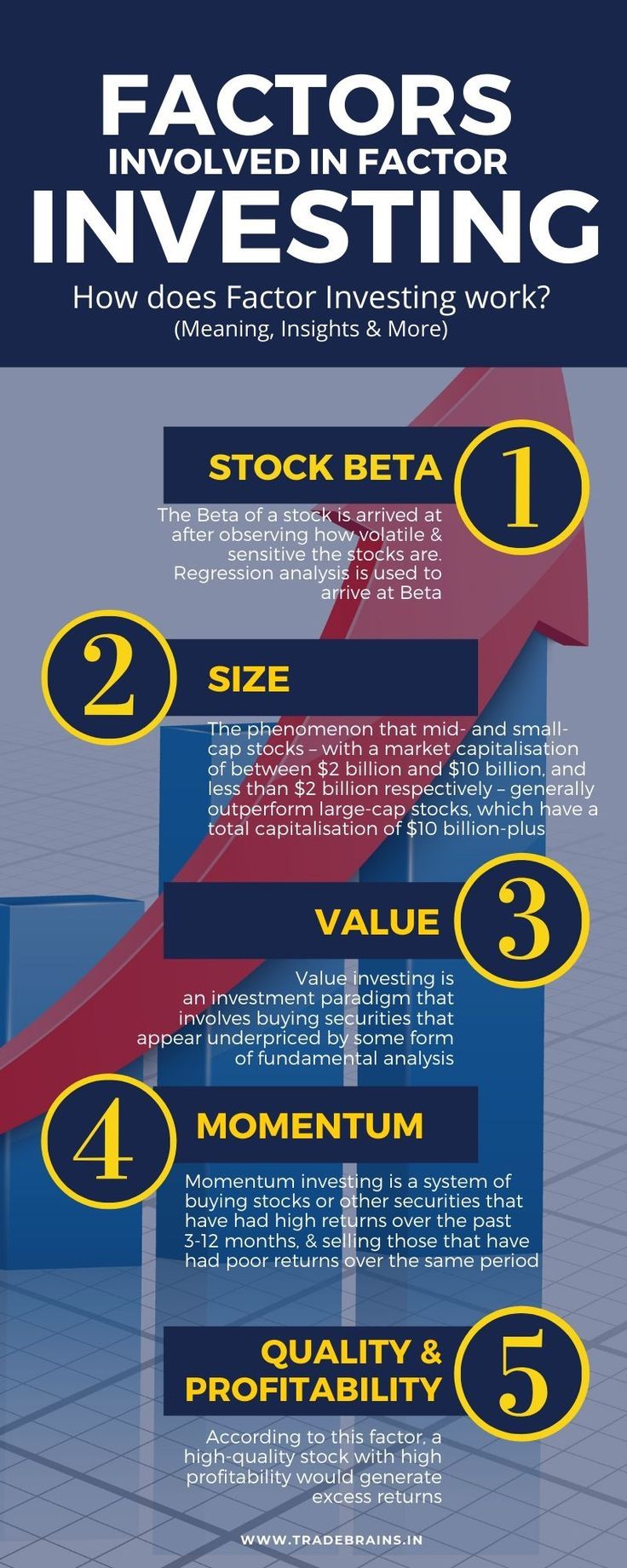

Excess Return

Fixed income factors include term and credit risk to manage exposure effectively.

Asset Classes

Implementation involves selecting factor ETFs or building a systematic portfolio strategy.

Measurable Characteristics

Factor investing offers a sophisticated approach beyond traditional index investing for enhanced performance.